The Fiscal Management of a VR Program is a paramount function of the overall organizational effectiveness of an agency. Without proper financial management, agencies run the risk of allocating and expending funds erroneously, which may lead to the provision of ineffective services and improper payments.

Understanding the fundamental elements of financial management, as outlined in federal statute and regulations, such as the UNIFORM ADMINISTRATIVE REQUIREMENTS, COST PRINCIPLES, AND AUDIT REQUIREMENTS FOR FEDERAL AWARDS (Uniform Guidance), the code of federal regulations for STATE VOCATIONAL REHABILITATION SERVICES PROGRAM, and The Rehabilitation Act of 1973, as amended by title IV of the Workforce Innovation and Opportunity Act (WIOA), is essential for ensuring that agencies not only remain in compliance with all funding requirements, but that agencies are empowered to make legal and ethical decisions.

The overarching goal of this VR Program Fiscal Management information is to provide tools and resources to help your agency understand the most prominent components of financial management.

These resources can help agencies…

- Plan expenditures effectively;

- Make expenditures effectively;

- Track expenditures effectively; and

- Report expenditures effectively.

The end result of sound fiscal practices is to assist VR programs in achieving program objectives related to individuals with disabilities obtaining employment.

Any questions about the topics on this page can be sent to qmfiscal@vrtac-qm.org.

As a Fiscal specialist that is new to the Vocational Rehabilitation Program, there are a number of topics that are unlike many other Federal grants and may be a significant learning curve. This series of videos and tools are intended to familiarize the new staff with the fiscal requirements of the VR Grant and provide additional resources to dig into certain topics at a deeper level.

Topics and training will continue to be added. If there is a topic you would like covered, or need additional information on, please email qmfiscal@vrtac-qm.org.

- VR Basics Part 1 Recording

- VR Basics Part 2 Recording

- VR Basics Part 3, Period of Performance

- VR Basics Part 4 Recording

Tools

These resources provide a comprehensive collection of regulations, sub-regulatory guidance, and key references, including 2 CFR 200, to support Vocational Rehabilitation (VR) programs. It is designed to help VR professionals navigate compliance requirements, fiscal responsibilities, and programmatic standards, ensuring alignment with federal guidelines. You can download a comprehensive collection or print only the resources you need

- Combined Resource (EDGAR Part 75-99, 2 CFR 200, 2 CFR 200 Part 3485, FAQ Food, Conferences, and Meetings)

- Education Department General Administrative Regulations (EDGAR) Parts

- 75 Direct Grant Programs

- 76 State-Administered Programs

- 77 Definitions that Apply to Department Regulations

- 79 Intergovernmental Review of Department of Education Programs and Activities

- 81 General Education Provisions Act Enforcement

- 82 New Restrictions on Lobbying

- 84 Governmentwide Requirements for Drug-Free Workplace

- 86 Drug and Alcohol Abuse Prevention

- 97 Protection of Human Subjects

- 98 Student Rights in Research, Experimental Programs, and Testing

- 99 Family Education Rights and Privacy

- 2 CFR 200 - OMB Uniform Grant Guidance (UGG)

- Part 200

- Part 3485 Nonprocurement Debarment and Suspension

- The updated UGG, effective October 1, 2024, is presented in a side-by-side comparison tool that contrasts the old regulations with the new ones, highlighting changes. Each section includes relevant excerpts from the preamble, providing additional context to help you understand the updates and their implications. This resource is designed to assist in revising and writing policies and procedures.

- VR Implementing Regulations

- Part 361 State Vocational Rehabilitation Services Program

- Part 363 State Supported Employment Services Program

- Part 367 Independent Living Services for Older Individuals Who Are Blind

- Part 395 Vending Facility Program for the Blind on Federal and Other Property

- Part 397 Limitation on Use of Subminimum Wage

Indirect Cost Rates (IDCRs) and Cost Allocation Plans (CAPs)

For planning, budgeting, and accounting purposes, it is important to account for the total costs of SVRA projects and programs properly. IDCRs and CAPs are the means by which costs are identified in a logical and systematic manner for reimbursement under Federal awards.

Indirect costs are those costs that are incurred for common or joint purposes and that benefit more than one organizational cost objective. Because indirect costs are not readily assignable to a specific cost objective defined in a grant program, tracking and recovering these indirect costs are an important challenge for organizations in analyzing the total cost picture for operating grant programs. Examples of indirect costs include salaries, and expenses for activities that benefit the entire organization, such as accounting, personnel, and purchasing costs.

An Indirect Cost Rate is an allocation methodology for determining fairly what proportions of an organization's administrative costs each program should bear. An Indirect Cost Rate represents the ratio between the total indirect costs and direct costs, expressed as a percentage.

Cost Allocation Plans are an allocation methodology that uses various allocation methodologies to distribute allowable direct and indirect costs to benefiting cost objectives.

Reviewing cost classifications is an important part of your overall fiscal management of the program. There is not a universal rule for classifying costs as either direct or indirect. Costs are classified based on the benefit received by the entity incurring the expenditure. The definition of the term “cost objective” is important to understand to determine what costs are indirect, versus direct. A cost objective is a program, function, division, activity, award, contract, or other work unit against which costs can be incurred.

IDCRs or CAPS are necessary to ensure SVRA compliance with 2 C.F.R. Part 200, and serves as documentation for auditors, and provides accurate information for management.

If an SVRA is experiencing questions or concerns about this topical area, it is best to contact the RSA Financial Management Specialist assigned to the agency.

Regulatory Citations:

- 2 C.F.R. Part 200 Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards

- There are many references in this part. We have highlighted a few of the specific sections below.

- 34 C.F.R. Part 76 State-Administered Programs

Resources:

- Cost Allocation Department of Education Guide for State and Local Governments

- Section VII: Common Indirect Cost Issues

- Department of Education Indirect Costs Online Training

This 45-minute course provides an overview of indirect costs. It will include how to define indirect, direct, and direct administrative costs and how to apply the Regulatory and Statutory Framework of these costs. After completing this course, you will be able to:- Define indirect costs, direct costs, and direct administrative costs.

- Apply the regulatory and statutory framework of these costs.

- Define an indirect cost rate (ICR).

- Identify factors affecting the allowability of costs.

- Determine the types of distribution bases.

- Calculate and apply an indirect cost rate.

- Understand the responsibilities of a grantee and cognizant agency when obtaining an indirect cost rate.

- Identify the types of indirect cost rates.

Receiving federal grant awards is imperative to the effective administration of VR programs as federal funding may account for approximately 78.7% of a state’s overall VR budget. Not only can this funding be used for indirect expenditures such as the salaries for administrative and clerical staff, but it may also be used for direct expenditures that are critical to the mission of serving those with the greatest barriers to employment.

Understanding the basic elements of federal funding is important because, in the event that funding is used inappropriately, VR agencies may be subject to sanctions as outlined in 2 CFR § 200.339.

The following are important basic concepts to understand regarding grant award issuance:

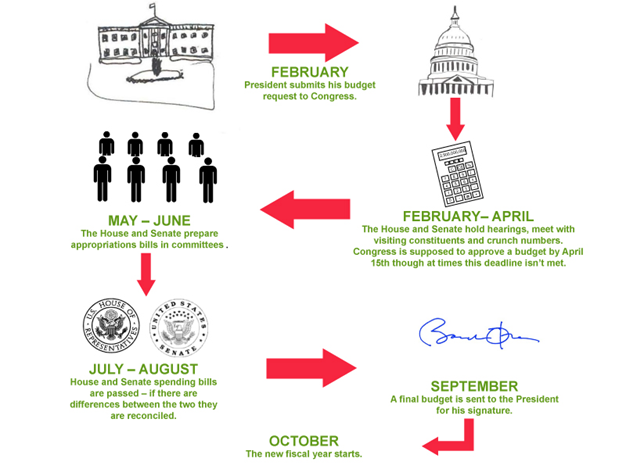

President’s Budget

The President initiates the annual budget cycle with the submission of an annual budget proposal for the upcoming fiscal year to Congress. The President is required to submit the annual budget on or before the first Monday in February. However, Congress has provided deadline extensions both statutorily and, sometimes, informally.

The President recommends spending levels for various programs and agencies of the federal government in the form of budget authority (BA). Such authority does not represent cash provided to or reserved for agencies. Instead, the term refers to authority provided by federal law to enter into contracts or other financial obligations that will result in immediate or future expenditures (or outlays) involving federal government funds. Most appropriations are a form of BA that also provides the legal authority to make the subsequent payments from the Treasury (https://crsreports.congress.gov/product/pdf/R/R42388).

The U.S. Department of Education posts the budget tables from the President’s Budget on the Department’s website. These are recommendations that are not representative of the funds agencies will receive. Do not view these as a hard line for budget planning.

Budget Resolution

The budget resolution is Congress’s response to the President’s budget. It is a concurrent resolution because it is an agreement between the House and Senate that establishes overall budgetary and fiscal policy to be carried out through subsequent legislation. The budget resolution must cover at least five fiscal years: the upcoming fiscal year (referred to as the “budget year”) plus the four subsequent years.

The budget resolution is not sent to the President and does not become law. It does not provide budget authority or raise or lower revenues; instead, it is a guide for the House and Senate as they consider various budget-related bills, including appropriations and tax measures.

Law establishes April 15 as the target date for congressional adoption of the budget resolution. Since FFY 1977, Congress has frequently not met this target date. In recent years, Congress often did not adopt a budget resolution.

There is no penalty if the budget resolution is not completed before April 15, or not at all.

Appropriation Measures

When considering appropriations measures, Congress exercises the power granted to it under the Constitution, which states, “No money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law.”

The Antideficiency Act explicitly prohibits federal government employees and officers from making contracts or other obligations in advance or in excess of an appropriation, unless authorized by law, and providing administrative and criminal sanctions for those who violate the act.

Under law, public funds may be used only for the purpose(s) for which Congress appropriated funds.

The timing of the various stages of the appropriations process tends to vary from year to year.

The Senate appropriations Committee typically begins reporting the bills in June and generally completes the committee consideration prior to the August recess. The Senate typically begins floor consideration of the bills beginning in June or July.

Conference Action

Once the House and Senate have both completed initial consideration of an appropriations measure, the Appropriations Committees in each chamber will endeavor to negotiate a resolution of the difference between their respective versions. The practice has generally been for the House and Senate to convene a conference committee to resolve differences between the chambers on appropriations bills. Alternatively, agreement may be reached through an exchange of amendments between the houses.

Regular appropriations bills contain a series of unnumbered paragraphs with headings, generally reflecting a unique budget account. Under these measures, funding for each department and large independent agency is organized in one or several accounts. Each account generally includes similar programs, projects, or items, such as a salaries and expenses account, although a few accounts include only a single program, project, or item.

Presidential Action

Under the Constitution, after a measure is presented to the President, the President has 10 days to sign or veto the measure. If the President takes no action, the bill automatically becomes law at the end of the 10-day period if Congress is in session. Conversely, if the President takes no action when Congress has adjourned, the President may pocket veto the bill.

Continuing Resolution

In general, budget authority provided in regular appropriations expires at the end of the FFY, September 30, unless otherwise specified. If action on one or more regular appropriations measures has not been completed by the start of the FFY, on October 1, the agencies funded by these bills must cease non-excepted activities due to lack of budget authority.

Continuing resolutions (CR) maintain the pre-existing appropriations at the same levels as the previous fiscal year (or with minor modifications) for a set amount of time. CRs typically provide temporary funding until a specific date or until the enactment of the applicable regular appropriations acts, if earlier. Once an initial CR becomes law, subsequent interim CRs may be used to make additional funds available.

In the event that Congress enacts a regular appropriation after a CR, the annual formula award amount to be received by each grantee will be calculated based upon the amount of the appropriation. Then, the total amount of funds awarded to the grantee through previous CRs will be subtracted from the annual formula award amount to determine the remaining balance due the grantee. This is important for fiscal planning purposes in the event there are multiple CRs and Congress enacts an appropriation at a funding level less than the previous FFY on which the CRs were based.

Mandatory Spending

Mandatory spending is composed of budget outlays controlled by laws other than appropriation acts, including federal spending on entitlement programs.

As a mandatory program, the VR program’s annual spending authority is generally increased by the Consumer Price Index for all Urban Consumers percentage. However, the final total spending authority amount can be affected by Congressional action (e.g., sequestration).

Why is it important to understand the budget process?

It affects the following:

- The amount of funds each grantee receives;

- When RSA can provide information to grantees regarding grant award amounts for a FFY;

- The timeframe in which the initial and, if necessary, subsequent grant awards may be issued; and

- The number of grant award supplements a grantee receives.

Grant Award Issuance

RSA’s grant award internal controls are contained in Standard Operating Procedures developed in accordance with Department policies that are updated at least annually and approved by the Department’s Risk Management Services.

VR Award Formula Variables

The Rehabilitation Act, as amended, sets out a formula for distributing VR grants to states and territories. Through this formula, a portion of the funds appropriated for the VR program are distributed to states based upon the grant allotment they received for fiscal year 1978. States’ 1978 allotments served to ensure that no state experienced a funding decrease when the formula was revised through a 1978 amendment to the Rehabilitation Act. Of the remainder of the funds, one-half is distributed based upon states’ general population and a factor that compares their per capita income to the national per capita income, and the other one-half, according to their population and the square of the per capita income factor. The larger a state’s population, the more funds it will receive. Conversely, the higher a state’s per capita income compared to the national level, the lower its allotment will be. The squaring of per capita income increases its influence on a state’s allotment. However, the formula mitigates the effect of per capita income for states with very high or very low per capita income levels by setting upper and lower limits. Ultimately, the final allotment for a state cannot be less than one-third of 1% of the total amount appropriated, or $3 million, whichever is greater. In federal fiscal year 2020, the minimum allotment was approximately $11 million.

Per Capita Income: The three-year average per capita income (PCI) average is calculated using the three most recent years of PCI data (available from the U.S. Department of Commerce, Bureau of Economic Analysis) that meet the requirements in Section 8(a)(2) of the Rehabilitation Act. PCI data is updated on each even-numbered year.

Population: Updated annually and is furnished by the U.S. Department of Commerce, Bureau of the Census by October 1 of the year preceding the fiscal year for which funds are appropriated.

When there are two VR agencies, the State is responsible for providing RSA with the percentage of the State’s VR and Supported Employment allotment that is to be awarded to each agency. Upon receipt of the State’s percentages, RSA will continue to allot federal VR and Supported Employment funds to each agency until such time as the State submits a formal request to change the allotment percentage(s).

U.S. Bureau of Labor Statistics Consumer Price Index

Issuance Time Frame

Generally speaking:

- Due to factors both within and outside the control of RSA, the agency works to issue grant awards or supplements within three to four weeks after the funds are made available; and

- If there is a short-term CR that would expire before RSA could issue the funds, the short-term CR funds are combined with the subsequent CR.

G6

G6, which can be accessed at g6.ed.gov, is the Department’s grant management system from which the following is entered and tracked:

- Grant award amounts for the initial grants are entered into G6 manually and verified by RSA fiscal unit staff employing a clear separation of duties;

- Federal Awardee Performance and Integrity Information System (FAPIIS) checks are completed;

- Unique Entity Identifier (UEI) information is verified;

- Specific Conditions or High-Risk Status language is added to the grant awards as needed;

- Grant Award Notifications (GAN) are created and signed electronically; and

- Grant awards are obligated and the GAN email is sent to grantee.

Note: List is not exhaustive.

Grant Award Notifications

RSA-1 Carryover of Federal VR Grant Funds

RSA-3 Prohibition Against Subgranting

RSA-4 Pre-Employment Transition Services

RSA-7 Treatment of Indirect Costs for Purchased Services

RSA-9 Performance and Financial Reports (Vocational Rehabilitation)

RSA- 12 Prohibited Use of Federal Grant Funds for Lobbying and Allowable Membership Costs

GAN Attachment 18F Written Notice of Beneficiary Protections

RSA serves as an integral partner for State VR programs and is charged with overseeing many functions that ensure the fiscal management of VR programs is effective and efficient to enable agencies to assist individuals in obtaining gainful employment. These functions include the following:

- Administering formula and discretionary grant programs authorized by Congress;

- Evaluating, monitoring, and reporting on the implementation of federal policy and programs and the effectiveness of vocational rehabilitation, supported employment, and other related programs for individuals with disabilities administered by RSA;

- Administering the federal awards in accordance with Uniform Guidance Requirements in 2 CFR part 200, Financing of State Vocational Rehabilitation Programs in 34 CFR part 361-subpart C, Education Department General Administrative Regulations (EDGAR) requirements, and program requirements; and

- Coordinating with other federal agencies, State agencies, and the private sector, including professional organizations, service providers, and organizations of persons with disabilities for the review of program planning, implementation, and monitoring issues.

What’s the bottom line?

As with any partnership, positive outcomes depend on all partners actively working toward a common goal. RSA provides funding, technical assistance, and monitors program activities and expenditures to ensure the VR program is achieving its goals. VR agencies collaborate with RSA to review, understand, and comply with the terms and conditions of the grant to achieve program outcomes. This very important partnership promotes organizational effectiveness, so that quality services can be provided to individuals with disabilities.

Connecting with RSA

Each agency is assigned a Financial Management Specialist to address fiscal concerns and provide technical assistance and a State Liaison to address overall programmatic concerns.

The following are direct links to help you identify your Agency’s assignments:

The FFY of appropriation is the FFY for which Congress appropriated funds to the U.S. Department of Education from which the Department awards program grants, specifically the period from October 1 through September 30. For example, the FFY 2024 State Vocational Rehabilitation Services grants were made from the 2024 FFY of appropriation, which covers the period of October 1, 2023, through September 30, 2024.

The Uniform Guidance uses the term “period of performance” rather than “grant period.” Period of performance is defined in 2 CFR § 200.1 in a manner like the EDGAR definition of “grant period.” A grantee may neither obligate nor pay expenditures for costs incurred prior to the start of the period of performance. For example, the cost for VR services provided to a consumer prior to the start of the period of performance for a grant award may not be charged to that grant award. Rather, those obligations must be charged to the prior grant award. Additionally, a grantee may not obligate award funds after the end of the period of performance for a grant award.

During the FFY of appropriation, the federal Funding Period listed in Box 6 of the GAN will be from October 1 to September 30 of that FFY. This represents the one-year period for which the award is made and in which the grantee may incur new obligations against the award. Section 19(a)(1) of the Rehabilitation Act permits grantees to carry over federal funds for obligation and expenditure in the subsequent FFY provided certain conditions are met, as described further below. This means that grantees may carry over the unobligated balance of federal funds for one FFY beyond the FFY of appropriation so long as the conditions of Section 19 of the Rehabilitation Act were satisfied.

For example, the FFY of appropriation for FFY 2023 awards began on October 1, 2022, and ended on September 30, 2023. The carryover period for FFY 2023 awards started on October 1, 2023, and ended on September 30, 2024. To carry over federal funds into the subsequent FFY for obligation and liquidation, grantees must:

- Have an unobligated balance of federal funds at the end of the FFY of appropriation (i.e., on September 30, 2023); and

- Have satisfied the applicable non-federal share requirement by the end of the FFY of appropriation (i.e., FFY 2023) for:

- The federal funds obligated or liquidated during the FFY of appropriation; and

- The unobligated balance of federal funds to be carried over to the subsequent FFY.

Upon submission of the grantee’s 4th quarter RSA-17 (which is for the reporting period ending September 30 of the FFY of appropriation), an RSA Financial Management Specialist will review the grantee’s report to determine whether the grantee met the requirements necessary to carry over federal award funds for obligation and liquidation in the subsequent FFY. If the grantee met the requirements of Section 19 of the Rehabilitation Act to carry over funds, RSA will process an administrative change to the current GAN extending the period of performance to include the carryover period. Upon completion of RSA’s administrative action, the grantee will receive a notice of a revised GAN with the revised period of performance that includes the carryover period.

Unless the Department authorizes an extension for the carryover period consistent with the requirements of Section 19 of the Rehabilitation Act, a non-federal entity must liquidate all obligations incurred under the federal award not later than 120 calendar days after the end date of the period of performance, as specified on the GAN (2 CFR § 200.344(b)).

Financial obligations means orders placed for property and services, contracts and subawards made, and similar transactions that require payment by a recipient under a Federal award that will result in expenditures by a recipient under a Federal award (2 CFR § 200.1). There is no authority for subawards, as defined in 2 CFR § 200.1, under the VR program, Supported Employment (SE) program and Client Assistance Program (CAP). Additionally, the future period in which obligations may be liquidated is limited by federal requirements and the terms and conditions applicable to the award. EDGAR requirements at 34 CFR § 76.707 provide additional guidance regarding when obligations are made.

For example, travel is considered obligated when the travel is taken, and personnel expenditures for State agency employees are considered obligated when the employee performs the services. In determining when an obligation is made, agencies must also follow their State laws, regulations, and policies and procedures, as applicable.

If the grantee has not met the requirements of Section 19 of the Rehabilitation Act to carry over federal funds for obligation and expenditure in the subsequent fiscal year, the grantee must incur all obligations, for which it has provided sufficient match funds, by the end of the FFY of appropriation (i.e., September 30). In this circumstance, the period of performance and the FFY of appropriation are the same. If the grantee has met the carryover requirements by the end of the FFY of appropriation, the period of performance will be extended to include the carryover period (subsequent FFY). This will enable the grantee to incur new obligations against federal award funds during the carryover period, as indicated by the revised period of performance on the Grant Award Notification (GAN). In other words, in this circumstance, the period of performance covers two FFYs – the FFY of appropriation plus the carryover year.

While the term “match” and non-federal share are used in the VR regulations, the process described in statute is “cost sharing.” As defined in 2 CFR §200.1, Cost sharing means the portion of project costs not paid by Federal funds or contributions (unless authorized by Federal statute). This term includes matching, which refers to required levels of cost share that must be provided.

See also 2 CFR §200.306 and 34 CFR § 361.60.

The VR program is administered through a Federal and State partnership, with the Federal government contributing no more than 78.7 percent of the total program expenditures. In recognition of this Federal-State partnership, each State must contribute a non-Federal share equal to at least 21.3 percent of total VR program expenditures (34 C.F.R. § 361.60(a)(1) and (b)(1)). By contributing the required non-Federal share through State-appropriated funds or other allowable sources, States are able to receive approximately $3.69 Federal VR dollars for every non-Federal dollar to pay for the costs of administering the VR program and, most importantly, providing critical services to individuals with disabilities, including individuals with the most significant disabilities, as they pursue employment.

The matching requirement is a State requirement. In instances when a State has both a blind and general VR agency, determination of whether a State met the required non-federal amount for total federal funds received is assessed on a State basis. This means that both agencies should partner, when possible, to review State goals and measure progress.

The unobligated balance (the amount of federal funds that VR agencies have not obligated to pay for contracts, services, activities, etc.) of authorized federal funds that a grantee may obligate and expend in a subsequent FFY provided the grantee has met the matching requirements by the end of the FFY of appropriation as outlined in Section 19 of the Rehabilitation Act of 1973, as amended Rehabilitation Act and 34 CFR § 361.64.

Non-federal share can only be credited as matching when obligated, in accordance with 34 CFR § 76.707, during the FFY of appropriation for an award. VR agencies must report all allowable non-federal expenditures incurred under the VR program, regardless of the source of funding, even if the amount reported exceeds the amount of non-federal share required to match the total federal funds awarded. This information is necessary for RSA to assess whether the State has met its maintenance of effort requirement under Section 111(a)(2)(B) of the Rehabilitation Act and 34 CFR § 361.62.

Additionally, third-party in-kind contributions are not an allowable source of non-federal share under the VR program and, therefore, should not be reported as non-federal expenditures (34 CFR § 361.60(b)(2)). Program income cannot be used to meet the non-federal share requirement 34 CFR § 361.63(c)(4).

Non-federal share expected from third-party cooperative arrangement (TPCA) certified expenditures of public agency staff salaries, when the TPCA staff has not yet completed the work, may not be included as an unliquidated obligation (or expenditure) because these expenditures cannot be certified until after the staff works the requisite number of hours. Pursuant to 34 CFR § 76.707(b), an obligation for services performed by State agency employees, including TPCA staff, is incurred at the time the work is performed.

All non-federal expenditures and obligations used for match purposes must be incurred during the FFY of appropriation. The VR agency must liquidate all unliquidated obligations reported as having been incurred by the end of the FFY of appropriation but not liquidated by that time. All unliquidated obligations reported for match purposes, incurred prior to the end of the FFY of appropriation, must be liquidated within the liquidation for that award (i.e., 120 days after the end of the period of performance, regardless of whether the award qualifies for carryover). Allowable unliquidated obligations incurred during the FFY of appropriation that are cancelled during the carryover period, or otherwise not liquidated after the FFY of appropriation, may not be used toward satisfying the match requirement for the FFY of appropriation for that particular award because those obligations never came to fruition for the VR program.

Maintenance of Effort (MOE) outlines a grantee’s administrative requirement to maintain a specified level of non-federal expenditures (effort) to avoid a reduction levied against a future federal grant.

VR agencies must report all allowable non-federal expenditures incurred under the VR program, regardless of the source of funding, even if the amount reported exceeds the amount of non-federal share required to match the total federal funds awarded. This information is necessary for RSA to assess whether the State has met its MOE requirement.

For purposes of the VR program, a State must report all non-federal expenditures in the FFY in which those expenditures are incurred for purposes of satisfying the MOE requirement because MOE is determined on an FFY basis, not on the basis of a period of performance for an entire grant award.

Non-federal obligations and expenditures incurred during the carryover year do not count toward the prior FFY of appropriation’s match requirement but will count toward the current FFY’s MOE requirement.

Non-federal expenditures for the purpose of establishing a facility for a community rehabilitation program (CRP) will not be counted toward the State’s MOE (34 CFR § 361.62(b)); however, these non-federal expenditures, if obligated or liquidated within the period of performance, count toward satisfying the State’s match requirement. Additionally, Non-federal expenditures for the purpose of constructing a facility for a CRP will not be counted toward the State’s MOE (Section 101(a)(17)(C) of the Rehabilitation Act and 34 CFR § 361.62(b)).

MOE waivers, allowable under 34 CFR § 361.62, are requested for an amount of non-federal funds to be waived, it is not a waiver of the entire requirement. In order to sufficiently determine the amount of funds requested in a waiver, grantees must wait until the end of the period of performance of an award, due to the fact that obligations satisfy the non-federal share requirement. Only after all expenditures have been completed can the grantee adequately determine the amount of funds necessary to request via the waiver.

MOE waivers may be requested when a State VR agency has a decrease in non-federal funding due to exceptional or uncontrollable circumstances, such as a natural disaster or serious economic downturn.

Resources

4.13.21 RSA MOE Presentation -The MOE presentation consists of four (4) parts:

- MOE Basics;

- MOE Deficit Determination, Penalties, and Waivers;

- Reallotment; and

- Program Considerations.

Reallotment is the process in which funds that cannot be used by one grantee, due to inability to meet non-federal share requirements or inability to fully expend federal funds, are relinquished by the original grantee and awarded to other grantees by the Commissioner of RSA (Section 110(b)(1) of the Rehabilitation Act and 34 CFR § 361.65(b)).

The reallotment process maximizes the use of appropriated funds under the State Vocational Rehabilitation Services (VR), Independent Living Services for Older Individuals Who are Blind (OIB), and State Supported Employment Services. Any funds received during reallotment are one-time funds and do not represent an ongoing addition to the State’s formula award allotment. Funds relinquished in reallotment represent a one-time reduction to the State’s funds and will not affect subsequent year formula grant award calculations.

Prior to requesting funds in reallotment, the State must ensure it can provide the required match (21.3% for VR, 10% for OIB, and 10% for the total amount of expenditures incurred with the half of the allotment reserved to provide Supported Employment services to youth with the most significant disabilities) for the additional funds received by September 30th of the FFY in which the funds are appropriated.

The total amount of funds available for reallotment in the VR program are dependent upon the amount of:

- Funds relinquished by VR agencies for the current FFY; and

- MOE deficits incurred by States that are not waived by the Secretary during the current FFY (i.e., MOE reductions).

States that request funds in reallotment and incurred an MOE reduction earlier in the FFY will have the MOE reduction amount deducted from the available pool of reallotment funds before determining the amount of additional VR funds awarded to the State through the reallotment process. This process ensures that a State cannot benefit from its own MOE reduction.

Example: An FFY 2019 MOE deficit was identified in January 2021 and an MOE reduction was levied in October 2021 against the FFY 2022 VR award.

- The MOE reduction would be included in the FFY 2022 VR reallotment pool; and

- The State VR agency incurring the MOE reduction will not be able to receive those funds back through FFY 2022 reallotment, but may receive other relinquished funds or MOE reductions incurred by other States.

In some cases, such as when there is a belief that matching requirements will not be met for the State or when one State VR agency can benefit from additional funding, a State may opt to transfer funds between its General and Blind agencies.

Note: If you are in a State with a General and Blind agency and wish to transfer funds between the agencies, YOU MUST formally request that RSA transfer the funds between awards. The VR and Supported Employment funds allotted to each agency by RSA may ONLY be used for the provision of the VR or Supported Employment services assigned to the agency under the vocational rehabilitation services portion of the Unified or Combined State Plan. For example, a VR agency that serves individuals who are blind may not use its VR funds for the provision of VR services to individuals that are not eligible to receive services through the blind agency. VR agencies that serve all disabilities do not face similar limitation as they are statutorily required to serve all groups.

Because the VR funds awarded under a Unified or Combined State Plan can only be used for consumers that are included in that agency’s plan, RSA must officially transfer funds between General and Blind agency awards. DO NOT use internal accounting adjustments to transfer funds between the two programs.

RSA processes the transfer by reducing the federal funds allotted to one agency and then transfers the funds to the other agency. State VR agencies must ensure sufficient federal award funds remain to be transferred and that sufficient non-federal share was/can be met in the year of appropriation for the transferred federal award funds. Requests to transfer funds during the carryover period of an award take additional time for RSA to process. Upon receipt of such a request, RSA must first de-obligate the funds being transferred and then submit a request for approval to award prior year funds. After obtaining permission to obligate prior year funds, RSA will obligate the funds to the receiving agency. This process may take up to 30 calendar days to complete. The Department of Education reserves the right to deny any transfer of funds requests submitted near the end of the period of performance for an award. VR agencies must provide RSA sufficient time to transfer the funds and ensure the receiving agency has time to obligate and liquidate the additional funds received prior to the end of the period of performance.

Contact your RSA Financial Management Specialist for details regarding how to submit a request to transfer funds between Blind and General awards.

Resources

Proper internal controls that provide accurate and timely financial reporting is important because it helps you and RSA determine if the requirements of 2 CFR § 200.302 (Financial Management) and 34 CFR, part 361, subpart C (Financing of State Vocational Rehabilitation Programs) are met. Furthermore, financial reporting may be used as a tool for fiscal forecasting. This can help you streamline and enhance the quality and efficiency of services that your State agency provides. It is noteworthy that internal control deficiencies in this area represents one of the most common fiscal findings identified by RSA through monitoring.

In accordance with 2 CFR § 200.328, financial reporting, as approved by the U.S. Office of Management and Budget, "must collect financial reports no less than annually. The Federal agency may not collect financial reports more frequently than quarterly unless a specific condition has been implemented in accordance with §200.208. To the extent practicable, the Federal agency should collect financial reports in coordination with performance reports." The recipient "must submit financial reports as required by the Federal award. Reports submitted quarterly or semiannually must be due no later than 30 calendar days after the reporting period." The final financial report "must be due no later than 120 calendar days after the conclusion of the period of performance. See also §200.344".

Resources

- RSA Formula Grant Programs: Federal Reports and Deadline

- DCL-25-02 Vocational Rehabilitation Financial Report (RSA-17) Instructions

- RSA-17 SF-425/RSA-2 Data Element Comparison - Crosswalk This comparison document lists the RSA-2 and SF-425 data elements that are comparable to RSA-17 data elements and outlines the differences between the three information collections.

- DCL-20-01 Revised Instructions for Completing SF-425 for CAP, OIB, and PAIR

- RSA-PD-18-01 Instructions for completing the federal Financial Report (SF-425) for the State Supported Employment Services program (CFDA 84.187A)

- RSA-PD-18-02 Instructions for Completing the federal Financial Report (SF-425) for the State Supported Employment Services Program, Including Extended Services, for Youth with the most Significant Disabilities

- Certification Regarding Lobbying State agencies must sign and submit this form to RSA in order to comply with the certification requirements under 34 CFR Part 82 New Restrictions on Lobbying. This certification is a material representation of fact upon which the U.S. Department of Education relies when it makes a grant or enters into a cooperative agreement.

- FAQs- RSA 17 Reporting

With the issuance of the Federal fiscal year (FFY) 2024 State Vocational Rehabilitation Services (VR) grant awards, the Rehabilitation Services Administration (RSA) added the following three reports, required under 2 C.F.R. § 200.330, to the Grant Award Notification (GAN) attachment titled Performance and Financial Reports (RSA-9):

- Real Property Status Report (Cover Page) (SF-429);

- Real Property Status Report Attachment A (General Reporting) (SF-429A); and

- Real Property Status Report Attachment C (Disposition or Encumbrance Request) (SF-429C).

The GAN attachment instructs awardees to use and submit the Real Property Status Report forms, beginning with the FFY 2024 grant awards, if VR program funds, program income, or non-Federal match funds were used to acquire, construct, or improve real property, thereby, giving the U.S. Department of Education a monetary Federal interest in that property.

For awardees that receive a carryover year, the first Real Property Status Reports will be submitted with the final FFY 2024 Vocational Rehabilitation Financial Report (RSA-17), which is due once the agency liquidates all financial obligations incurred under the Federal award, but no later than 120 calendar days after the end date of the period of performance (January 30, 2026) as specified in the terms and conditions of the Federal award.

RSA will be providing training on how to complete and submit the property forms. Contact the Financial Management Specialist assigned to your State or email any questions to RSAFiscal@ed.gov

Citation: 2 C.F.R. § 200.330 - Reporting on real property.

The Federal agency or pass-through entity must require the recipient or subrecipient to submit reports on the status of real property in which the Federal Government retains an interest. Such reports must be submitted at least annually. In instances where the Federal Government’s interest in the real property extends for 15 years or more, the Federal agency or pass-through entity may require the recipient or subrecipient to report at various multiyear frequencies. Reports submitted at multi-year frequencies may not exceed a five-year reporting period. The Federal agency must only require OMBapproved government-wide data elements on recipient real property reports.

See 2 CFR 200 Appendix XII for additional details. If your agency receives federal funds exceeding the $10,000,000 annual threshold, you must self-disclose, semiannually:

- All violations of federal criminal law involving fraud, bribery, and gratuity violations that could potentially affect an ED award.

- Provide notification of certain proceedings within the last 5 years.

2 CFR § 200.1 Definition-Internal Controls and 2 CFR § 200.303 Internal Controls are two important references when looking at internal controls.

Internal controls means a process, implemented by state agencies, designed to provide reasonable assurance regarding the achievement of objectives in the effectiveness and efficiency of operations, reliability of reporting for internal and external use, and compliance with applicable laws and regulations.

Internal controls serve to safeguard assets and prevent fraud, waste, abuse, improper payments, and mismanagement. They include methods and procedures the agency uses to manage the day-to-day operations of grant-supported activities to assure compliance with applicable federal requirements and that performance goals are being achieved.

There is no standardized set of internal controls as they will differ based on each agency’s structure, processes, and State requirements.

RSA’s review of internal controls is to determine whether the agency’s internal controls meet the requirements at 2 CFR § 200.303 Internal Controls that the the recipient or subrecipient is managing the federal award in compliance with federal statutes, regulations, and the terms and conditions of the federal award.

The State is authorized to adopt any set of internal controls that meets the requirements at § 200.303.

Resources

- Department of Education-Internal Controls Online Course

This 40-minute course provides an overview of internal controls and explains what they are and why they are important. It also provides information about the categories of objectives, regulatory requirements and guidance to develop internal control systems, the components and principles of internal controls and the interrelationship between them. - GAO Greenbook Standards for Internal Control in the federal Government

- Committee of Sponsoring Organizations of the Treadway Commission (COSO)

- Internal Control Management and Evaluation Tool

- 2019 Internal Controls - WINTAC Presentations (PowerPoint) - Scorll to Spring 2019

Implementing contracts is important because it ensures that all parties involved are on the “same page.” In more detail, contracts help outline clear goals, evaluation criteria, and additional terms and conditions for the services that will be provided.

This section addresses the requirements related to contracting for purchased services. Uniform Guidance requires that States follow the same policies and procedures it uses for procurements with non-federal funds 2 CFR § 200.317. Contract policies are necessary to ensure that contract language results in the VR agency receiving allowable services, can appropriately assign the obligation to a grant award, can ensure expenditures align with original obligations, and receive the necessary data that it must collect and report with the frequency required by the terms and conditions of the VR award 2 CFR § 200.302(b)(7), and 34 CFR § 361.51.

In addition, VR agencies are responsible for the oversight of the Federal award. The recipient must monitor its activities under Federal awards to ensure they are compliant with all requirements and meeting performance expectations: 2 CFR § 200.329(a).

Through the use of contracts, VR agencies must relate financial data and accomplishments to performance goals and objectives of the federal award, consistent with the reporting of data on the SF-425, RSA-17, and RSA-911 reports 2 CFR § 200.329(b).

Resources

Subgranting describes the process in which the original grantee awards all or part of the grant to another individual or entity.

Subgranting/Subawards are only permissible in the Independent Living Services for Older Individuals who are Blind program because that program is specifically authorized by statute to make grants to public and nonprofit private agencies or organizations. The vocational rehabilitation program MAY NOT subaward, consistent with the EDGAR requirements in 34 C.F.R. § 76.50(b) that indicate the authorizing statute determines the extent to which a State may make subawards. Since the Rehabilitation Act is silent on the use of subawards in the VR program, they are not permitted.

VR agencies are required to develop and maintain written policies governing rates of payment for all purchased services. These policies outline the process the VR agency completes to ensure the rates of payment for VR services are allowable, reasonable and allocable to the award.

Resources

- Rate Setting Methodology Guide

- 34 CFR § 361.50 This section covers the written policies governing the provision of services for individuals with disabilities, including rates of payment for ALL purchased VR services.

- 2 CFR § 200.303 This is Uniform Grant Guidance and addresses internal controls.

- 2CFR § 200.403 This is Uniform Grant Guidance and addresses factors affecting the allowability of costs.

- 2 CFR § 200.404 This is Uniform Grant Guidance around reasonable rates which the VR agency should consider and incorporate when finalizing written policies governing rates of payment for VR services.

- 2 CFR § 200.405 This is Uniform Grant Guidance and addresses the allocability of costs.

The Uniform Guidance requires prior written approval for various grant award activities and proposed obligations and expenditures. Prior approval means the written approval by an authorized official of a Federal agency of certain costs or programmatic decisions.

Resources

In accordance with Section 110(d)(1) of the Rehabilitation Act, “the State shall reserve not less than 15 percent of the allotted funds for the provision of pre-employment transition services.” These reserved funds, as outlined in 34 CFR § 361.48(a), can only be used for the “required, authorized, and pre-employment transition coordination activities” “for all students with disabilities, as defined in § 361.5(c)(51), in need of such services, without regard to the type of disability, from federal funds reserved in accordance with § 361.65, and any funds made available from State, local, or private funding sources.”

Understanding and properly managing the pre-employment transition services reservation of funds is essential because States must determine whether the funds reserved for the provision of pre-employment transition services are sufficient to meet the needs of all students with disabilities needing the “required” activities listed in section 113(b) of the Rehabilitation Act and 34 C.F.R. § 361.48(a)(2), as well as the coordination activities listed in section 113(d) of the Act and 34 C.F.R. § 361.48(a)(4), prior to using reserved funds for “authorized” activities listed in section 113(c) of the Act and 34 C.F.R. § 361.48(a)(3).

The following are some resources to help you plan for and manage the reservation of funds for pre-employment transition services.

Resources

- Pre-ETS Calculator

- Pre-employment transition services set-aside determination guide

- Pre-Employment Transition Services GAN Attachment

- RSA FAQs Pre-ETS Fiscal From calculating reserve funds to assigning personnel to understand the potential consequences, this resource covers the most frequently asked questions about the fiscal side of Pre-Employment Transition Services.

- Strategies for Managing the Pre-Employment Transition Services 15 Percent Minimum Reserve Requirement

- Notice of Interpretation

Program income is considered received in the FFY in which the grantee receives the funds 34 CFR § 361.63 and 2 CFR § 200.1. Therefore, any program income that the grantee receives is only considered received in the FFY of appropriation. For reporting purposes, that means program income will never increase after the 4th quarter. Any program income received during the subsequent FFY, is considered earned in the next FFY’s grant award, regardless of the basis of accounting, or if carryover requirements are met. Program income from Social Security Administration (SSA) reimbursements transferred to other eligible programs is restricted to the grant award year that corresponds to the FFY of appropriation in which it was received in the VR program.

Social Security's Vocational Rehabilitation CR program, authorized in 1981, is only available to State VR agencies. The two purposes of the CR program are:

- To make State VR services more readily available to Social Security beneficiaries with disabilities; and

- To generate savings to the Social Security Trust Fund, for Social Security Disability Insurance (SSDI) beneficiaries and to the General Revenue Fund, for Supplemental Security Income (SSI) recipients.

Under the CR program, the Social Security Administration pays State VR agencies compensation in the form of reimbursement when beneficiaries served by State VR agencies enter the workforce and achieve nine continuous months of earnings. The earnings must be at or above the Substantial Gainful Activity (SGA) level, called a continuous period of SGA. When the beneficiary achieves this benchmark, the State VR agency completes the Vocational Rehabilitation Provider Claim form (SSA-199) and submits it to Social Security with supporting documentation. This documentation includes a breakdown of the direct costs associated with the case.

The payment period starts with the beneficiary’s date of onset for SSDI beneficiaries or the date of entitlement for SSI recipients. The payment period ends with the ninth month of SGA level earnings, or the month before the last month of SSDI entitlement or SSI eligibility, whichever comes first. CR claims must be filed timely to qualify for payment. A claim is considered timely if filed with Social Security within 12 months of the last day of the ninth month of SGA level earnings. If the claim is approved, the reimbursement constitutes a lump sum payment to the State VR agency. The compensation received is considered program income.

A VR grantee may choose to transfer SSA payments received by the VR program to carry out programs under part B of title I of the Act (client assistance), title VI of the Act (supported employment), and title VII of the Act (independent living) 34 C.F.R. § 361.63(c)(2). This authority is unique only to program income received from SSA. There is no legal authority for the VR agency to transfer other forms of program income earned under the VR program to another program for that program’s use. Each program receiving SSA payments for its use must report the funds as program income received for that program.

Refunds and rebates are not program income 2 CFR § 200.1.

In accordance with 34 CFR § 361.63(c)(3)(ii), to the extent available, the non-federal entity must disburse funds available from program income (including repayments to a revolving fund), contract settlements, refunds and rebates, audit recoveries, and interest earned on such funds before requesting additional cash payments. Program income received in the VR program and transferred to an allowable program is considered disbursed for purposes of the VR program and this requirement.

Resources

The government passed the Single Audit Act of 1984, as amended in 1996, to ensure that organizations receiving federal grants use the funds in compliance with the federal government's requirements.

So even though RSA is not coming out each year to look at your financials, the State Legislative Auditor is performing this function on behalf of the federal government.

The federal government provides instructions to the State Legislative Auditor on focus areas for this audit: 2025 Compliance Supplement. The Compliance Supplement is based on the requirements of the 1996 Amendments and 2 CFR part 200, subpart F, which provides for the issuance of a compliance supplement to assist auditors in performing the required audits. CFDA 84.126 Rehabilitation Services- Vocational Rehabilitation Grants to States can be found starting at page 4-84.126-1 Department of Education (ED).

This is even more reason to ensure your financial house is in order, you have a good understanding of the requirements, and you are able to demonstrate you have used the federal funds according to requirements.

Many times, auditors are unfamiliar with your particular program and may come to a different conclusion. For example, they may question the allowability of consumer purchases such as buying llamas for a self-employment plan. If you run into issues and the audit team is not listening to you, we recommend that you have the auditors call RSA and talk to the fiscal team. However, while the Compliance Supplement is provided for consideration for auditors, there is no requirement for them to use it. State auditors may write audit findings inconsistent with VR requirements or program regulations, but RSA may choose not to sustain the findings.

The Vending Facility program authorized by the Randolph-Sheppard Act provides persons who are blind with remunerative employment and self-support through the operation of vending facilities on federal and other property. The act authorizes a blind individual licensed by the State licensing agency to conduct specified activities in vending facilities through permits or contracts 34 CFR Part 395 Vending Facility Program for the Blind on federal and Other Property.

VR agencies serving as the State Licensing Agency are authorized by the Randolph-Sheppard Act to set aside funds for the purposes set forth in the statute. Such expenditures, in certain categories, are considered as non-federal expenditures in support of the federal VR program. These expenditures must also be reported as non-federal expenditures on the VR agency’s financial reports for the purposes of determining match and MOE.

- Acquisition of new and replacement equipment

- Maintenance and repair of equipment

- Management Services and Supervision

State licensing agencies are also required to complete an annual reporting form (RSA-15) related to the Randolph-Sheppard Vending Facility program which is used to evaluate and monitor the program. This report is due by December 30, 90 days following the close of the FFY.

Resources

- RSA RS Website Link

- RSA-TAC-25-01 Allowable Use of Funds for Management Services for the Benefit of the RSVFP

- RSA-TAC-24-06 Allowable Costs for Vending Facilities and Equipment for Vendors Under the Randolph-Sheppard Vending Facility Program

- RSA-TAC-24-03 Use of VR Program Funds for Initial Stocks and Supplies and Operating Expenses for Vendors Under the Randolph-Sheppard Vending Facilities Program

- RSA-TAC-22-01 RSA Approval of State Rules

- RSA-TAC-21-01 Active Participation of Elected Committees of Blind Vendors with State Licensing Agencies in the Randolph-Sheppard Vending Facility Program

- RSA-TAC-21-02 The Application of the Randolph-Sheppard Act Priority for Blind Vendors to the Operation of Vending Machines on Federal Property and the Use of Third-Party Vendors on that Property

- RSA-PD-99-05 The Use of Title I Funds for the Maintenance and Repair of Equipment Under the Randolph-Sheppard Act

- RSA-PD-92-09 Federal Financial Participation in the Payment by States of Arbitration Panel Damages Award under the Randolph-Sheppard Act

- RSA-PAC-89-02 Guidelines for Use of Federal Financial Participation and Set-Aside Funds in the Randolph-Sheppard Vending Facility Program

- Randolph-Sheppard Act Financial Relief and Restoration Payments Appropriation - Part One

- RSA-FAQ-21-06 Randolph- Sheppard Act Financial Relief and Restoration Payments Appropriation - Part Two

VR funds may be used for the establishment, development, or improvement of a public or non-profit CRP to provide VR services to applicants and eligible individuals of the VR program that promote integration into the community and competitive integrated employment, including supported employment and customized employment (Section 103(b)(2) of the Rehabilitation Act and 34 CFR § 361.49(a)(1)).

The VR agency must evaluate the needs of VR participants in the comprehensive Statewide needs assessment (CSNA) 34 CFR § 361.29 to determine whether the VR agency can establish, develop, or improve a public or non-profit CRP 34 CFR § 361.5(c)(16) and (17) and 34 CFR § 361.49(a)(1). The need to establish, develop, or improve a CRP, along with goals and priorities and strategies to address the need, must be reported in the VR services portion of the Unified or Combined State Plan. Prior to implementation of establishment or construction VR agencies must have implementing policies and procedures.

Due to the complexity of requirements for establishment and construction, such as prior approval requirements and the requirement for the building (if applicable) to be in use for the established purpose for 20 years (Section 101(a)(17)(B)), VR agencies should strongly consider contacting RSA prior to undertaking an establishment or construction project.

34 CFR part 361, subpart F provides a description of the One-Stop

Delivery System and outlines detailed operational requirements. According to 34 CFR § 361.300(a), the One-Stop aims to merge “workforce development, educational, and other human resource services in a seamless customer-focused service delivery network that enhances access to the programs' services and improves long-term employment outcomes for individuals receiving assistance.”

Although the various One-Stop partners administer separately funded programs, there is a shared goal of providing services to help increase the consumers’ access to training and educational opportunities, while removing additional barriers to employment as needed.

Below are some resources to help you understand and manage the requirements for being a required partner of the One-Stop Delivery System, including financial contributions related to the VR agency’s proportionate use of the one-stop center and relative benefits received.

Resources

- Sharing American Job Center Costs Using “Customer Count:” One Approach to Cost Allocation under WIOA

- RSA-TAC-17-03 Infrastructure Funding of the One-Stop Delivery System

- RSA-TAC-17-02 One-Stop Operations Guidance for the American Job Center Network

- RSA-TAC-15-02 Vision for the State Vocational Rehabilitation Services Program as a Partner in the Workforce Development System under the Workforce Innovation and Opportunity Act

- 34 CFR § 361.420 What are the roles and responsibilities of the required one-stop partners?

- 34 CFR § 361.500 What is the Memorandum of Understanding for the one-stop delivery system, and what must be included in the Memorandum of Understanding?

- 34 CFR § 361.700 through 361.760 Read this entire section about one-stop infrastructure costs

Section 111(a)(1) of the Rehabilitation Act makes clear that State Vocational Rehabilitation Services (VR) funds are allocated to each State to pay for costs incurred under the VR program. VR implementing regulations at 34 C.F.R. § 361.3 require State VR agencies to use VR program funds solely for the provision of VR services and the administration of the VR program. VR services are those provided to individuals with disabilities (Section 103(a) of the Rehabilitation Act and 34 C.F.R. § 361.48) and to groups of individuals (Section 103(b) of the Rehabilitation Act and 34 C.F.R. § 361.49). Section 103(b)(5) of the Rehabilitation Act and 34 C.F.R. § 361.49(a)(4) permit VR agencies to provide technical assistance services to businesses who are seeking to employ individuals with disabilities. Administrative costs, for purposes of the VR program, are defined at Section 7(1) of the Rehabilitation Act and 34 C.F.R. § 361.5(c)(2). Administrative costs include costs incurred when providing information about the VR program to the public or providing technical assistance and support services to other State agencies, private non-profit organizations, and businesses and industries (except for the technical assistance to businesses described above as services to groups, which are VR services and not administrative costs) (Section 7(1)(C) and (D) of the Rehabilitation Act and 34 C.F.R. § 361.5(c)(2)(iii) and (iv)). When providing information to the public about the VR program or technical assistance (regardless of whether the technical assistance provided is a VR service or an administrative cost) and support services to other State agencies, private non-profit organizations, or businesses, State VR agencies may use VR grant funds, non-Federal funds for match purposes, or program income to pay for these expenditures under the VR program.

It is important to remember that when brochures and other information include or benefit multiple programs, the costs must be allocated to the programs accordingly. When issuing statements, press releases, requests for proposals, bid solicitations and other documents describing projects or programs funded in whole or in part with Federal money, U.S. Department of Education grantees shall clearly state the –

- Percentage of the total costs of the program or project which will be financed with Federal money;

- Dollar amount of Federal funds for the project or program; and

- Percentage and dollar amount of the total costs of the project or program that will be financed by non-governmental sources.

In this context, the term “other documents” means any document not covered by those specified (i.e., statements, press releases, requests for proposals, and bid solicitations) that describes programs or projects that are funded in whole or in part with Federal funds. This would include brochures disseminated by the VR agencies that describe the various services offered, brochures describing eligibility criteria for the VR program, or any other brochures, pamphlets, or documents that provide information about the VR program to VR applicants and consumers and the public, or technical assistance to businesses. All such documents must satisfy the requirements set forth in Attachment 11 to the VR GAN regardless of whether they are disseminated in print or video format or electronically (including websites, webinars, and other electronic formats).

Generally speaking, Uniform Guidance at 2 C.F.R. § 200.467 indicates that costs of selling and marketing any products or services of the recipient are unallowable unless they are allowed under § 200.421 and are necessary to meet the requirements of the Federal award. The provision of information about the VR program, technical assistance, and support services is separate and distinct from certain advertising and public relations costs identified in Uniform Guidance and governed by 2 C.F.R. § 200.421. The provision of information about the VR program is focused on the provision of factual information about the VR program, such as the services it provides and the individuals it serves.

The provision of technical assistance and support services involves providing consultative services – using the VR agency’s expertise in working with individuals with disabilities – to assist other entities in working with individuals with disabilities. With respect to outreach and advertising, Uniform guidance indicates allowable advertising costs include program outreach (for example, recruiting project participants) and other specific purposes necessary to meet the requirements of the Federal award (2 C.F.R. § 200.421(b)(4)). Public relations, on the other hand, are those activities dedicated to maintaining relations with the community (2 C.F.R. § 200.421(c)). The Uniform Guidance at 2 C.F.R. § 200.421(e)(3) makes clear that the costs of promotional items are not allowable. Promotional items would include pens, notepads, cups, and other items with the VR agency’s logo stamped on them that the agency uses to distribute to the public or businesses as a means of doing community outreach and ensuring good community relations. As such, the costs to produce these promotional items are not allowable under the VR program and, therefore, may not be paid for with VR grant funds, non-Federal funds for match purposes, or program income.

The information provided above is consistent with the Department’s interpretation of the Uniform Guidance requirements at 2 C.F.R. § 200.421(e)(3) and is applicable to all of RSA’s grant awards.

In accordance with Public Law 101-166, Section 511, Steven’s Amendment, you are required to disclose the percent of costs financed with federal funds, the federal dollar amount, and the percentage and dollar amount financed by nongovernmental funds. This requirement is intended to give the federal government public credit for federally funded programs and projects.

When issuing statements, press releases, requests for proposals, bid solicitations, and other documents describing programs or projects funded in whole or in part with federal money, grantees receiving federal funds shall clearly state:

- The percentage of the total costs of the program or project which will be financed with federal money;

- The dollar amount of federal funds for the project or program; and

- Percentage and dollar amount of the total costs of the project or program that will be financed by non-governmental sources.

For instance, you would include a statement in a bid solicitation that indicates the following:

"This (project/publication/program/website, etc) is (X %) funded by the U.S. Department of Education, Rehabilitation Services Administration as part of an award totaling (insert the award amount here) with X% financed from non-governmental sources.

The services described in this brochure are funded, in part, with federal funds awarded by the U.S. Department of Education under the Vocational Rehabilitation (VR), Supported Employment Services, and the Independent Living Services for Older Individuals Who are Blind (OIB) programs. For purposes of the VR program, the federal VR grant paid 78.7 percent of the total costs of the program. In federal fiscal year (FFY) 2024, the VR agency received $XXX,XXX,XXX in federal VR funds. Funds appropriated by the State paid 21.3 percent of the total costs ($XXX,XXX,XXX) under the VR program. For purposes of the Supported Employment program, federal funds paid 95 percent of the total costs. In FFY 2024, the VR agency received $XXX,XXX,XXX in federal Supported Employment funds. State appropriated funds paid 5 percent ($XXX,XXX,XXX) of the total costs under the Supported Employment program. For purposes of the OIB program, federal funds paid 90 percent of the total costs incurred under the program. In FFY 2024, the agency received $XXX,XXX,XXX in federal grant funds for this program. Funds appropriated by the State paid 10 percent ($X,XXX,XXX) of the total costs incurred under the OIB program.

It’s important to note that this disclosure should also be prominently displayed on your website to ensure transparency and compliance.

For staff that work on multiple cost objectives, personnel costs must be allocated proportionally between all the different programs administered by the VR agency, and other programs staff work on within the designated State agency (DSA) even if outside the designated Staff unit (DSU) or included in the indirect cost rate or cost plan.

In the past, guidance referenced that personnel cost activities required certified personnel reports for individuals working 100% on one activity. Sometimes, agencies referred to these as PARS (personal activity reports). While PARS are not specifically required, you are required to ensure that your time and effort record-keeping meets the standards cited in regulation. However, 2 CFR 200.430 (i)(8) states that the Federal Government may require PARS if you do not meet the standards described in this section. This citation is referenced below.

It is important to have a policy/procedure that outlines the agency’s practices for reporting time and effort. This policy/procedure should include internal controls to ensure the process is evaluated, and it should outline how and when training will be conducted with all employees to ensure the proper allocation of staff time.

The purpose of the Vocational Rehabilitation Program is to help individuals with disabilities prepare for, regain, or retain competitive integrated employment. This means that eligible individuals with disabilities throughout the state may receive any service available through the VR program they may need if such services support the achievement of their employment goal, so long as the individual’s disability priority category is able to be served if the VR agency is under an Order of Selection. Additionally, the VR program must provide pre-employment transition services to all students with disabilities in the state who may need them in collaboration with the State and Local Education Agencies.

In accordance with 34 C.F.R. § 361.25, services provided under the VR services portion of the Unified or Combined State Plan must be available in all political subdivisions of the State, unless the designated state unit (DSU) requests a waiver of statewideness which RSA approves as part of the VR portion of the Unified or Combined State Plan.

Section 101(a)(4) of the Rehabilitation Act and 34 C.F.R. § 361.26 permits a VR agency to request a waiver of statewideness through its State Plan (description b) from RSA before implementing services in discrete areas of the State, so long as a local public agency is providing non-Federal funds to meet the non-Federal share of the costs of those services.

What is a Waiver of Statewideness?

Notwithstanding the general principle of statewideness, under some circumstances, a Designated State Unit (DSU) may wish to increase services or expand the scope of services that are available statewide under the VR portion of the Unified or Combined State Plan. For instance, a DSU may wish to increase certain services in a local area (e.g., supported employment services) that would lead to substantially increased numbers of individuals achieving competitive integrated employment. A DSU may also wish to address the rehabilitation needs of individuals with specific impairments so that they can more effectively develop services that address their employment goals. In either situation, the local public agency must provide the non-Federal share for the federal funds used in the project, often through a third-party cooperative arrangement or interagency cash transfer. VR may count the interagency transfer of funds from the public agency to VR as meeting the non-Federal share of the costs of those services for purposes of the VR program, as would be required by 34 C.F.R. § 361.26(a)(1). The non-Federal funds provided by the local public agency may come directly from the agency or may be contributed to the local agency from a private agency, organization, or individual. These requirements for a waiver of statewideness can be found in 34 C.F.R. § 361.26(a).

How to Request a Waiver of Statewideness

In order to be approved by RSA, the DSU must submit a waiver that contains the information and assurances in 34 C.F.R. § 361.26(b). The waiver must:

- Describe the services to be provided under the agreements with local providers. This should include a description of the number of individuals that will be served and the level of funding provided in each agreement. The DSU can often justify the needs for services in specific local areas based on the DSU's comprehensive statewide needs assessment (CSNA).

- Contain a written assurance from the local public agency that it will provide the non-Federal share of funds. However, it is important to note that these agreements with local agencies do not relieve the DSU of its administrative responsibilities for the VR program. Therefore, the DSU must approve any new services resulting from these agreements before they are provided.

- Contain a written assurance that the DSU approval will be obtained for each service before it is provided.

- Contain a written assurance that all the administrative requirements of the State Plan are adhered to, including an Agency’s order of selection requirements, as individuals with disabilities served in those areas of the State under the waiver of statewideness must be in an open category of the order.

The U.S. Department of Education has provided guidance for grantees when considering the use of Federal award funds for conferences and meetings. There are several factors to take into consideration. The following resources also address the use of Federal award funds to pay for food.

Resources

BABAA was enacted as part of the overall Infrastructure Investment and Jobs Act in November 2021. The purpose of the BABAA is to create demand for domestically produced goods, helping to sustain and grow domestic manufacturing and the millions of jobs it supports throughout product supply chains. Broadly, BABAA requires that Federal infrastructure programs must use materials produced in the United States. Effective October 23, 2023, the Office of Management and Budget revised the OMB Guidance for Grants and Agreements. The revisions are limited in scope to support the implementation of the Build America, Buy America Act provisions of the Infrastructure Investment and Jobs Act and to clarify existing provisions related to domestic preferences. These revisions provide further guidance on implementing the statutory requirements, including a new part 184 and revising 2 CFR 200.322. Changes are summarized on the Department of Education website under News.

The following specific goods when acquired under an infrastructure program and being used for construction, major remodeling, or broadband infrastructure are covered:

- Iron and steel used in an infrastructure project in the United States.

- All manufactured products used in an infrastructure project in the United States.

- All construction materials used in an infrastructure project that are manufactured in the United States.

Goods that do not fit the definition of manufactured products or construction materials are not subject to the BABAA domestic sourcing requirements.